Your personal brand matters almost as much as your business pitch these days. Investors scrutinize you as an individual, not just your product.

Almost 9 out of 10 investors say that trusting the founder is really important when deciding where to put their money. Your personal brand shows people you’re trustworthy, a leader, and in it for the long run.

As AI gets better, what you put out online matters more than ever. Search engines and investors are looking for founders who show they know what they’re doing and have real experience.

So, if you want to stand out and secure funding, you need to cultivate a strong, consistent personal brand across all platforms. It’s the key to building trust and attracting the right investors for your venture.

Understanding why this is important for entrepreneurs.

| Core Branding Element | Role in Investor Decision-Making |

| Clear Positioning | Shows you understand your niche and audience |

| Consistent Messaging | Reinforces trust and leadership |

| Public Proof of Expertise | Demonstrates capability and results |

| Authoritative Presence | Improves both SEO and investor confidence |

Key Takeaways

- Personal branding for entrepreneurs is no longer optional, it’s expected.

- Investors use your brand to assess credibility, influence, and readiness.

- Search engines like Google now reward founders who demonstrate EEAT through content, visibility, and trust-building signals.

- A refined personal brand can be your strongest competitive edge in securing funding.

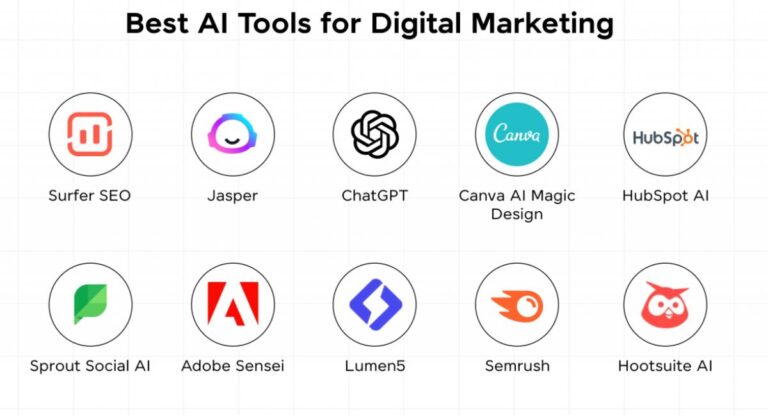

Read More:- Top 7 AI Tools Every Entrepreneur Should Use in 2025

What Investors Look for in a Founder

Investors don’t just examine your business model, they size you up as the founder. The impressions you make count a lot, whether you’re giving a pitch in person or building your online presence.

In the startup world after 2025, your personal brand is what people look at first to decide if you’re worth working with. Investors always try to figure out if you’ve got what it takes to build, lead, and grow a company when things get tough.

Before they even look at your numbers or forecasts, investors search for specific traits in founders that hint at long-term promise and low risk.

5 Things Investors Notice First

| Attribute | Why it Matters to investors |

| Domain Expertise | Proves you understand the space you’re disrupting |

| Vision & Values | Signals long-term thinking and alignment with market needs |

| Online Visibility | It helps establish trust and shows you’re knowledgeable about the topic. |

| Communication Skills | Reflects your ability to pitch, lead, and attract talent |

| Consistency | Shows you’re intentional, reliable, and brand-aligned |

What This Means for Entrepreneurs

- Domain expertise isn’t optional investors want founders who’ve either lived the problem or studied it deeply.

- Your vision should connect not just to your product, but to where your industry is heading.

- Visibility online (through content, social media, and interviews) acts as scalable social proof.

- Strong communication skills reflect how well you can pitch, negotiate, and lead under pressure.

- Brand consistency across your website, LinkedIn, interviews, and content helps position you as a serious, trustworthy founder.

Founder Tip

Before reaching out to investors, do a brand audit:

- Is your LinkedIn headline aligned with your pitch?

- Does your “About” section reflect your values and mission?

- Do your blog posts or social content reflect thought leadership?

These seemingly small details can play a big role in how investors perceive your potential.

The Foundation of a Strong Personal Brand

A strong personal brand doesn’t just happen. You build it on purpose, based on what matters to you, and show it in everything you do your pitch, your content, and how you appear online.

Founders who gain trust on the internet and in meetings know that personal branding goes beyond looks. It’s about sending clear, believable, and steady messages that make you seem like a leader people want to support.

4 Pillars of a Trustworthy Brand

| Pillar | What It Means |

| Clarity | Define exactly who you are, what you do, and who you serve. |

| Credibility | Showcase results, credentials, press, partnerships, and testimonials. |

| Consistency | Align your messaging across platforms LinkedIn, pitch decks, interviews. |

| Connection | Use human language and storytelling to create relatability and engagement. |

These four elements work together to establish trust before a conversation even begins.

Building on the 4 Pillars

- Clarity: Confused founders don’t get funded. Your messaging must communicate your mission in one sentence or less. Avoid jargon. Speak directly to your audience whether it’s investors, customers, or talent.

- Credibility: Back your claims with proof. Feature traction, testimonials, press mentions, or awards. Use real numbers and external validation to build authority.

- Consistency: In 2025, Google evaluates identity coherence. Make sure your LinkedIn, About page, pitch deck, and media bios all reflect the same positioning and tone.

- Connection: People don’t remember stats, they remember stories. Share your founder journey, personal insights, and lessons learned. This builds emotional resonance with investors.

Bullet Recap Quick Wins for Founders

- Secure a custom domain (e.g., yourname.com) and build a simple personal website.

- Update your LinkedIn headline to clearly state your value proposition.

- Write a short, authentic Founder Story that is SEO-optimized and aligns with EEAT (Experience, Expertise, Authoritativeness, Trustworthiness).

- Make sure your pitch deck bio, social bios, and speaker profiles all use the same positioning and voice.

A strong personal brand isn’t about being everywhere, it’s about being strategic, intentional, and authentic in how you show up. This is how you move from being another founder in the inbox to one that investors remember and trust.

Read More:- Top 10 Healthcare Leaders in the USA – 2025 .

Aligning Your Brand with Investor Psychology

Building a personal brand isn’t just about visibility, it’s about influence. The most effective founder brands are designed with investor psychology in mind. To attract funding, your brand must not only inform but also inspire trust, create curiosity, and signal long-term value.

Investors are constantly filtering thousands of pitches, profiles, and people. Your goal is to stand out by triggering the emotional and rational cues that help investors say, “This founder gets it.”

Key Psychological Triggers That Influence Investment

- Trust

Investors must believe you can execute your vision. You build trust by being consistent, transparent, and credible across all channels your social profiles, content, and pitch materials. - Confidence

Confidence doesn’t mean arrogance, it means showing command of your space. When you speak or publish content that’s insightful and practical, you present yourself as a capable founder. - Curiosity

Sharing bold ideas or unique insights makes investors want to know more. Curiosity leads to conversations, and conversations lead to funding. - Urgency

Why now? Your brand should answer this implicitly. Highlight timely industry shifts, unmet market needs, or innovation gaps that make your startup especially relevant at this moment.

How to Apply This to Your Brand

- Use storytelling to humanize your journey: how did you get here, and why does it matter now?

- Be present in niche conversations on platforms like LinkedIn or X (Twitter), where early-stage investors pay attention.

- Regularly publish thought leadership that reflects your insight and foresight, not just product updates.

- Position your brand around a clear “why now” narrative investors are more likely to back momentum than potential.

A founder’s brand should feel intentional and self-aware. When your values and expertise align with the emotional drivers that influence investment decisions, your brand becomes more than a presence it becomes a magnet.

Read More:- Natural Remedies for Insomnia That Actually Work

Content Strategies That Build Trust

Content is often your first impression with investors. They look for signs of real-world experience, industry insight, and a clear voice. To build trust, your content must reflect who you are, what you know, and why you’re credible, all aligned with EEAT principles.

Why Content is Key to Building a Fundable Personal Brand

Investors research founders long before taking a meeting. Your online content acts as a credibility engine, signaling your experience, knowledge, and authority in your industry.

Google’s 2025 algorithms increasingly prioritize content that reflects real-world expertise, authentic voice, and consistent thought leadership. This is why aligning your content with EEAT (Experience, Expertise, Authoritativeness, Trustworthiness) is not just good for SEO it’s essential for building investor trust.

Create Content That Shows Experience

Investors want to see that you’ve been in the trenches. Share insights from:

- Product challenges and pivots

- Lessons from past startups or roles

- Customer feedback and real-world data

- Day-in-the-life posts that show how you lead

This positions you as someone who doesn’t just theorize you execute.

Publish to Build Authoritativeness

Where you publish is just as important as what you publish. Make sure your name appears across platforms that investors trust:

- Medium blogs with expert insights

- Guest posts on startup-focused publications

- Podcast interviews or LinkedIn Lives

- Speaking engagements and virtual panels

The goal: appear where decision-makers are already paying attention.

Be Consistent Across Every Touchpoint

Google and investors both look for consistency. That means your:

- LinkedIn profile

- About page

- Founder story

- Blog articles

- Social media tone

…should all align around the same positioning, message, and voice.

If you talk like a visionary in your pitch but sound generic online, you create friction. Consistency removes doubt and builds familiarity which leads to trust.

Use Content to Build Real-World Trust

Don’t over-polish. Investors want authentic stories, not just hype.

Try these formats:

-

- Personal stories about tough decisions or failures

- Frameworks or mental models you use to solve problems

- Advice to fellow founders or aspiring entrepreneurs

These make your brand relatable and human two traits investors respect.

Read More:- Ryan Heckman’s journey from Olympic skier to entrepreneur

Mistakes to Avoid in Founder Branding

A strong personal brand builds trust. But even subtle missteps can damage credibility in the eyes of investors. Inconsistent messaging, overhyping, or neglecting key platforms can quietly signal risk, something investors avoid. Avoiding these common mistakes helps position you as a founder worth backing.

Common Founder Branding Mistakes to Avoid

- Inconsistent Messaging Across Platforms

If your website says one thing, your LinkedIn another, and your pitch deck something else investors notice. Keep your story, tone, and value proposition aligned. - Generic or Vague Positioning

“Tech entrepreneur building innovative solutions” isn’t enough. Be specific about what you do, who it’s for, and why it matters now. - Lack of Engagement with Your Audience

Ignoring comments, DMs, or not showing up regularly online gives the impression that you’re detached or unavailable, not ideal for investor confidence. - Overhyping Without Proof

Bold claims need to be backed by data, case studies, or testimonials. Hype without evidence signals a lack of maturity or transparency. - Outdated or Incomplete Profiles

An old LinkedIn photo, broken links on your site, or no recent updates can make you seem inactive or uninvested in your own brand.

Case Studies of Funded Founders with Strong Brands

Nothing builds belief like real examples. Many founders who successfully raised funding in recent years share one thing in common: a clear, credible, and consistent personal brand. These case studies show how branding helped them stand out and win investor trust.

Arjun Seth SaaS Founder Who Built Trust Through Transparency

Arjun publicly shared the story of his failed first startup. Instead of hiding it, he used the experience to highlight what he learned. This approach made him relatable and trustworthy. When he launched his second venture, he quickly attracted angel investors who respected his resilience and clarity of purpose.

Emily TranFemTech CEO Who Grew a Loyal Investor Following

Emily focused on LinkedIn as her primary channel. She posted short, insight-rich updates about building her product, working with users, and solving real health issues. Within six months, she built a community and caught the attention of two VCs who saw both her traction and her vision.

Key Lessons from These Founders

- Be open about your journey, not just the wins, but the growth moments.

- Show up consistently online. Visibility builds trust over time.

- Use your personal voice. Investors invest in the human behind the pitch.

Read More:- Japanese Trading House: Rally After Buffett’s Berkshire Hikes Stake

Advanced Tips to Stand Out to Investors

Once your personal brand has the basics clarity, consistency, and credibility you can go further. These advanced strategies help position you not just as a founder, but as a thought leader investors seek out.

- Own a Clear Point of View: Don’t just echo industry trends and challenge them. Share your unique take on market gaps, innovation, or customer behavior. Founders with sharp perspectives are seen as visionary.

- Publish Fou+nder-Led Thought Leadership: Write articles, record short videos, or speak on panels. Use your platform to teach what you know. This content builds authority and helps investors understand how you think.

- Build Social Proof Outside of Your Circle: Collaborate with other credible founders, appear on niche podcasts, or contribute to respected publications. These third-party mentions elevate your brand and expand your reach.

- Use Strategic Storytelling in Your Pitch: When meeting investors, lead with a short story that connects your mission to a real-world problem. Emotional resonance makes your pitch memorable.

- Be Searchable and Discoverable: Make sure your name surfaces with clarity on Google. Use schema markup, author bios, and consistent content publishing to improve search presence. Investors often do due diligence through a quick search of what they find should reinforce trust.

Conclusion: Make Your Brand Your Advantage

In 2025, personal branding for entrepreneurs isn’t optional, it’s a competitive edge. Investors are drawn to founders who lead with clarity, prove their value through action, and show up consistently across digital channels.

Personal branding is expected to remain highly relevant in 2030, with the industry projected to grow significantly. ( Source: Inc )

If you want to attract investors to your startup, start by building a brand that communicates more than your title. Share your vision. Tell your story. Be findable, credible, and clear. Your personal brand is your first pitch, make sure it speaks before you do.