Investment strategies are not only the process of building capital but also an opportunity to free up a person’s life and create their path to Success.

Like in any business, with changes in the financial industry. investors must change their ways of doing things to meet the constantly changing market situations.

Here, you will find articles on investment strategies, what is currently trending in the market, and known advice for a smarter investment choice.

The First Things to Consider For and About investment strategies for achieving success.

However, before speaking about the specific approaches let’s familiarize ourselves with the basics of investing. In simple terms, investing involves the use of capital with anticipation of gains in the future/Investing refers to the use of capital. especially money with the aim of realizing profit in the future.

It categories of return can also be in the form of

- capital gain (increase in value of the asset)

- interest

- dividend.

Why Invest?

- Wealth Accumulation: Savings allow people to be able to accumulate funds to meet economic necessities for instance buying a home, affording tuition fees, or preparing for post-working years.

- Inflation Hedge: Inflation reduces the buying power of money hence by investing one is able to counter or overcome this problem, that is be able to preserve wealth.

- Passive Income: Some kinds of investments provide people with regular receipts. such as dividends from shares or rental income from real estate, which can lead to financial freedom.

Popular Investment Strategies

-

Value Investing

Graham’s value investing is about establishing an investment in the shares of companies whose quoted prices on the market are lower than their real worth. Fundamental investors who apply this strategy pay particular attention to value proposition, striving for stock equity with improved earning ability and long-term competitive securities.

Example: Warren Buffet one of the most successful value investors, bought millions of shares. when Coke was trading at such a low price primarily looking at the competitive advantage of the company. This was evident in the fact that over the years, the price of this stock began to rise waiting for that ultimate bounce according to Buffett.

-

Growth Investing

Growth investing focuses on stocks of organizations that are projected to have a better growth rate than their rivals. It usually entails funding industries such as information technology, biotechnology, or green energy.

-Example: The example of growth stocks is the Amazon company.

- It had excellent growth and Success.

- especially in e-commerce and cloud computing.

which brought great returns to early investors in the following years.

-

Index Fund Investing

They are usually low-risk investment products that track the returns of a given market index, like the Standard and Poor’s 500. It provides diversification against actively managed funds and also costs less than a majority of them.

Example: It creates an investment environment where everyone who invests in an S&P 500 index . will be in a position to mimic overall market performance without even having to know which specific stocks to buy.

-

Dividend Investing

Dividend investing is an investment strategy dealing with securities that offer consistent dividend yields, which can be compounded or collected. This strategy is more so suitable to those in the retirement age or to anyone who is needy of regular accounts income.

Example: Some companies that have paid dividends include Procter &Gamble Co.,. Johnson & Johnson among others many investors prefer companies such as these firms given their rich histories in paying their dividends.

Issues and Factors Affecting Investments strategies and Its Current Market Trends !

Being abreast with market trends is very important in the management of an investment program. Here are some key trends currently shaping the investment landscape:

ESG Investing

SRI, Socially Responsible Investing has become more popular in the past few years due to the increased demand for sustainable investment.For instance, companies that adhere to good ESG practices are likely to get capital meaning.

that investors are now turning over to sustainable investment.

Technology Integration

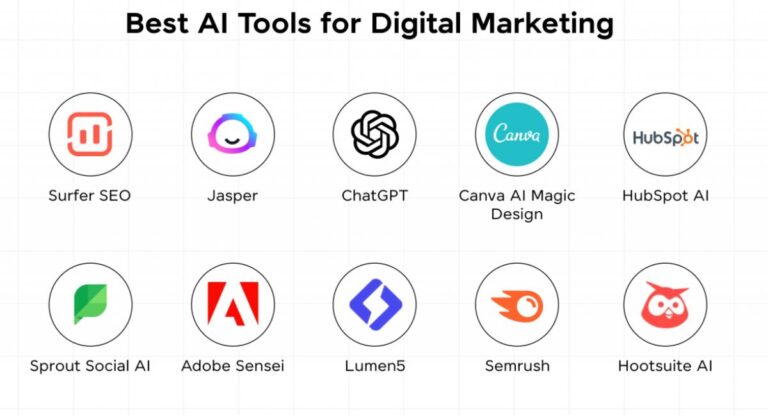

The ever-increasing advancement in technology, known as fintech is revolutionizing the way investors get access to markets.

Modern technologies available to the users fine investment strategies.

- mobile applications for investment

- self-managed robot/AI based advisors

- Platform-based investment solutions that enable the investors to make immediate decisions complimenting the readily available statistical data.

Digital currency / Cryptocurrency and Virtual currency / Digital asset

In this contest, with the appearance of cryptocurrencies such as Bitcoin and Ethereum, one finds new opportunities as well as risks. It is thus about time that investors in this category got to know about its volatility and the pertinent risks in the system.

Interest Rate Dynamics

Monetary policies introduced by the central bank have a great influence on investment strategy. An increase in some social factors affects the interest rates hence increasing borrowing costs and the stock and bond markets.

Because central banking can impact the following investment strategies. operations of an organization, investors should follow such announcements to align their operations appropriately.

DISCOVER YOUR UNIQUE FINANCIAL –Investment Strategies

For this purpose, let us propose a fictional character, Maya, who is interested in constructing her investment portfolio. Here’s how she can create a personalized investment plan:

1.Define Financial Goals :

Maya first describes her financial goals:

- saving for herself for retirement.

- buying a house.

- for her children’s education.

The direction influences the correct investment approach since clear objectives are derived from it.

-

Assess Risk Tolerance

These are what must be understood about her risk tolerance. Maya determines her tolerance to risk in terms of one’s ability to bear the risk of losses .as well as the fluctuating market to determine the proportion of her portfolio that will go into the various assets.

-

Diversify Investments

To mitigate risk, Maya allocates her investments across various asset classes:

- Stocks: A combination of value and growth-oriented stocks to obtain the best results of both worlds.

- Bonds: Such as fixed income and stability that can consist of government and corporate bonds.

- Real Estate: Going for a real estate investment trust (REIT) to invest in the property market.

-

CEM = Continuing Education and Monitory

Maya will focus on the trends that become apparent in market risks she will also dedicate time . resources to go through her portfolio to ensure she is on the right track with her goals and risk appetite. This can make it easier for her to e-learning, so that she may be in a position to notice changes in the market.

Tips for Successful Investment Strategies

- Start Early and Be Consistent: Markets take time beats timing. So, it is better to invest a certain amount periodically and even a small investment, as the money will start compounding over this period.

- Stay Disciplined: Defensively motivated decisions are likely to lead to the wrong investment strategy choices. Patience with your investment strategy and not to make irrational decisions due to market swings should be emphasized.

- Regularly Rebalance Your Portfolio: However, like any other factor in the market, the value of your assets may change. It is all about achieving the required amount of allocation of assets and the required level of risk.

- Seek Professional Guidance: In case you are still in doubt, seek an investment consultant who can help you based on your individual characteristics.

Conclusion

When it comes to wealth creation or planning the financial future then investment is one of the most effective investment strategies. Knowing various schemes of investments, being updated with new change.

designing the right investment map are a few ways where you will be able to handle all the sections of finance more safely. Good investment is all about the long run, and therefore, it is not a race to the finish line with a siren – it is a marathon race.

If you enjoyed reading this article you should join other successful,

- investors

- traders

- corporate executives

- CEOs

by subscribing to our weekly Magazine.